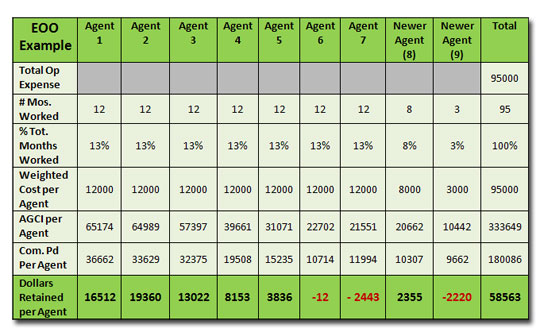

My argument for measuring environmental efficiency in a ‘desk-less’ environment is through determining ‘Dollars Retained per Agent’ (DRA) via ‘Weighted Costs per Agent’ (WCA). By understanding this metric, an EOO Ratio can be calculated. It is important to note that DRA is not calculating ‘average’ dollars retained per agent, but is rather a retention number specific to each producing sales agent. DRA can be determined in the following manner:

Agent AGCI (Adjusted GCI) – (Commissions Paid + WCA) = Dollars Retained per Agent (DRA)

Adjustments to GCI

Adjustments to GCI include things such as E&O charged to sale agents, desk fees paid by agents, transaction fees and marketing fees paid by agents and the like. It is a way of ‘truing-up’ numbers resulting from a given sales agent’s productivity.

Weighted Cost per Agent (WCA)

Weighted Cost per Agent is determined by weighting the number of months an agent worked during a measured period against total operating costs during that same period, as shown in the example below. It is necessary to have such a weighting system in order to create metrics for newly licensed agents and experienced agents who were hired at some point during the LTM period and as a result, worked less than 12 full months. This view is also helpful in:

- Assessing the success of training programs, or

- Comparing productivity of new and existing agents

WCA places a value on each sales professional as an individual ‘profit center’ and thereby presents a superior vantage point for real estate companies.

In this example, it is interesting to note that Newer Agent 8, with 8 months worked is profitable to the branch, whereas Agent 7 who was present the entire 12 months is not. This is true even though agent 7 had a higher AGCI. In fact, Newer Agent (9), who earned far less AGCI than did Agent 7, brought very similar net dollars (negative number) to the branch! This would suggest that we have made a very strong new hire with Newer Agent (9), but that Agent 7 needs to be coached toward higher productivity.

Total Operating Cost x {0a8e414e4f0423ce9f97e7209435b0fa449e6cffaf599cce0c556757c159a30c} of total months worked by sales agent = Weighted Cost per Agent

The clear implication of the preceding argument is that the company leaders will have determined a minimum acceptable DRA for agents to remain viable in their organization. Agents who are achieving this level satisfy the minimum Dollars Retained per Agent requirements and those who fall below that mark are in need of coaching or redirecting.

The EOO Ratio is calculated by dividing the number of agents achieving DRA by the total number of agents in the office. Hence for the example above.

7 (Agents Achieving DRA) / 10 (Total # Agents) = 70{0a8e414e4f0423ce9f97e7209435b0fa449e6cffaf599cce0c556757c159a30c} EOO Ratio