I am tired of all the negativity surrounding our industry these days, so here are the facts. Currently we have many favorable market drivers, which collectively make 2009 the optimum year to buy a home. There are also millions of potential home buyers and investors who are well able to muster the necessary down payment and have sound credit history which enables them to move forward. Yet, all that we hear about from the media is the gore that seems, for some ungodly reason, to create good headlines. Of course the economy is very tough right now and no one would deny that fact, but there are many points of strength that no one seems to be talking about.

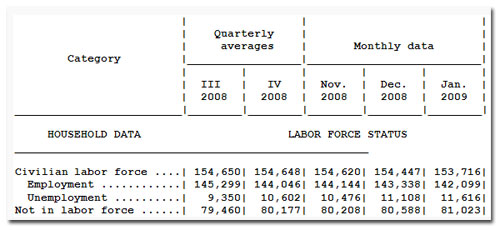

According to the United States Bureau of Labor Statistics we have a 92.4{0a8e414e4f0423ce9f97e7209435b0fa449e6cffaf599cce0c556757c159a30c} employment rate (142,099,000 employed) in the U.S., as of January 2009. Please see the chart below for clarification.

In addition to this, we also have;

- 35-year lows in mortgage rates hovering around 5{0a8e414e4f0423ce9f97e7209435b0fa449e6cffaf599cce0c556757c159a30c} +/- and the Fed taking hard steps to keep rates down

- Mortgages available with a solid down payment (20{0a8e414e4f0423ce9f97e7209435b0fa449e6cffaf599cce0c556757c159a30c}) and good credit history (720 or better), and

- Home prices that in most markets resemble levels not seen since 2003, or earlier

As a consequence of all of these factors combined, even if home prices were to decline another 5{0a8e414e4f0423ce9f97e7209435b0fa449e6cffaf599cce0c556757c159a30c}, but interest rates rise by a percent or more, homes would still cost the consumer more in the future than they do right now. To be conservative, the example that follows assumes that interest rates will only rise by 1{0a8e414e4f0423ce9f97e7209435b0fa449e6cffaf599cce0c556757c159a30c}. In reality, when rates begin to move they tend to do so with greater volatility.

As a consequence of all of these factors combined, even if home prices were to decline another 5{0a8e414e4f0423ce9f97e7209435b0fa449e6cffaf599cce0c556757c159a30c}, but interest rates rise by a percent or more, homes would still cost the consumer more in the future than they do right now. To be conservative, the example that follows assumes that interest rates will only rise by 1{0a8e414e4f0423ce9f97e7209435b0fa449e6cffaf599cce0c556757c159a30c}. In reality, when rates begin to move they tend to do so with greater volatility.

$300,000 Mortgage @ 5{0a8e414e4f0423ce9f97e7209435b0fa449e6cffaf599cce0c556757c159a30c} = $1,610.46

Principle and interest payment/per month

$285,000 Mortgage @ 6{0a8e414e4f0423ce9f97e7209435b0fa449e6cffaf599cce0c556757c159a30c} = $1,708.71

Principle and interest payment/ per month

2009 is the year that everyone will look back on and say to themselves “I should have bought a home then.” It is preposterous for any thinking person to conclude that none of the currently employed 142,099,000 persons have sufficient monies for a down payment and the requisite credit history. Yet in all of this, the media wants to dwell on negativity and we in the Real Estate business are not doing enough to counteract it.

So, what is the real estate industry waiting for? It is up to us and no one else to get the word out to the buying and selling public. If we do not take charge now, fully expect that our clients and customers will hold us accountable for it on one, not-so-distant day, when this opportunity is past. This will surely happen and you can quote me on it.